Insights

The Role of Cash is Changing

Is the role of your banknotes changing? For all the talk about a decline in cash demand, data shows a steady rise in the value and the number of banknotes in circulation. During the last decade, the number increased by 40 percent – but it should not come as news. When people now store more of their wealth in cash, that weakens the business case for expensive low value notes and increases the need for modern banknote security.

Yes, the number of notes in circulation continues to increase, while the number of non-cash payments continues to grow. It was against this backdrop that prompted Andrew Bailey, Chief Cashier at the Bank of England in 2009, to label the phenomenon “a paradox”. In 2021, the ECB had reason to revisit the banknote paradox when it reported a huge growth in circulating euros.

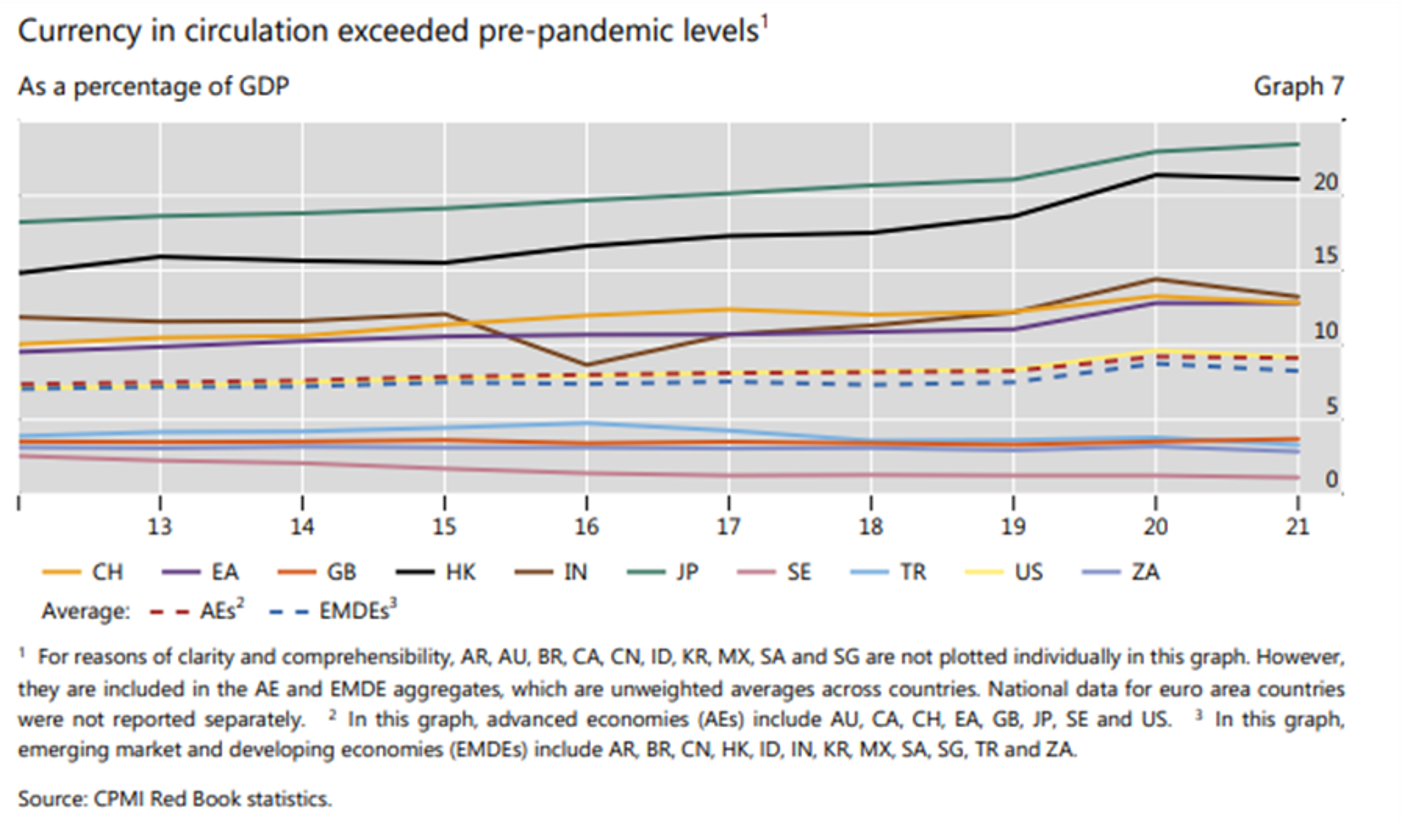

The paradox is not limited to Europe. BIS Red Book data show the same robust growth in cash (well ahead of GDP) across eight advanced economies and twelve emerging and developing economies. A more personal way to appreciate this is to consider that the number of banknotes held globally on a per person basis has increased by over 40% in the last decade.

This suggests that, in the face of an undeniable increase in non-cash payments, cash growth is being driven by savings when many nations report higher growth in larger denominations. At the same time, cash’s transactional use and circulation velocity appear to be falling, especially impacting the demand for lower value notes.

What are the Implications?

- Low value notes may reside in wallets longer as cash is used less.

- This may weaken the business case for using expensive polymer or laminate substrates as notes naturally last longer.

- Higher value banknotes may require better security options as their use as medium and long-term stores of value increases.

What are Central Banks Doing?

Crane undertakes a yearly study of all banknotes issued. In the past 12 months only 4 percent of the new designs issued are printed on polymer.[1] In all, 99 new banknote designs were issued last year, 78 denominations or 96 percent (by issuance volume) on paper.

Security features such as Crane’s micro-optics and SICPA’s color changing features, which have strong counterfeit resilience and public usability, continue to grow, i.e., used on 18% and 27% of new designs, respectively. This is in contrast with inferior security features typically used on lower value banknotes.

Conclusion

In this paradoxical payments world of slowing cash velocity, steady increases of cash in circulation and rocketing growth in digital payments, it appears that security remains the most important attribute for banknotes – especially as people worldwide continue to store significant portions of their wealth in cash.

[1] By Issuance volume. This compares with a market share of approximately 6% of all issued banknotes.